BusinessWire India

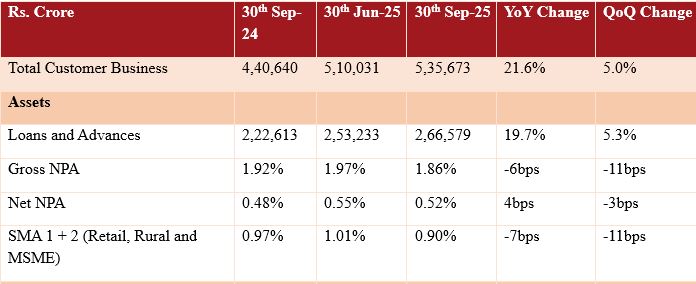

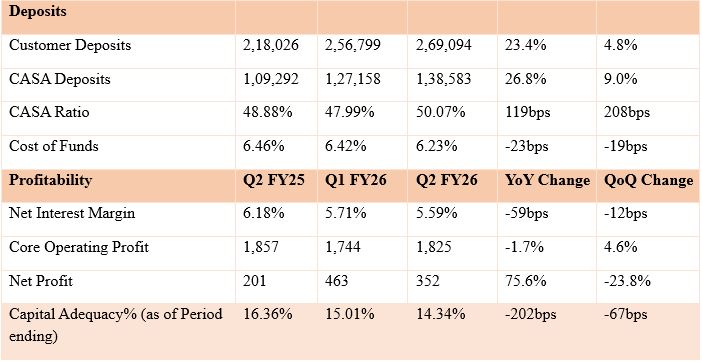

Mumbai (Maharashtra) [India], October 20: Financial results: IDFC FIRST Bank published the unaudited financial results for quarter and half year ended September 30, 2025 as follows:

Note: Loans and advances include credit substitutes. NIM is Gross of IBPC & Sell-down. PAT in Q1FY 26 included trading gains of Rs. 495 crore against trading gains of Rs. 56 crores in Q2 FY 26. PAT is up on a sequential basis on core profitability basis. Capital Adequacy includes profits of respective Quarter or Half year.

Notes:

1. 94% of the YoY growth in loans and advances of the Bank is constituted by growth in Mortgage Loans, Vehicle loans, Consumer loans, Business Banking, MSME loans and Wholesale loans.

2. Microfinance portfolio reduced by 41.6% YoY as of September 30, 2025. MFI book at 2.7% of funded assets against 5.6% as of September 30, 2024.

3. Credit card issued by the Bank reached 4.0 million during Q2 FY 26.

4. Private Wealth Management AUM grew 28% YoY and stood at Rs. 54,693 crore.

5. Asset quality indicators of the Bank, including Gross NPA, Net NPA, SMA, and Provisions of the book continue to remain stable. MFI business asset quality has further improved.

6. Provisions for the Quarter reduced 12.5% QoQ from Rs. 1,659 crore to Rs. 1,452 crore, primarily on account of lower provisions in the microfinance book.

7. The Bank has utilized micro-finance provision buffer of Rs. 75 crore during Q2 FY26 on account of reduced stress in MFI, and continues to carry the balance of Rs. 240 crore as contingent provisions.

8. Post conversion of capital raised through CCPS of Rs. 7,500 crores into equity, the Capital adequacy ratio and TIER-I ratio would be 16.82% and 14.75%, as computed on the financials as of September 30, 2025.

Commenting on the results, Mr. V Vaidyanathan, MD and CEO, said, “The stress in the MFI business was an MFI industry issue and looks like it is behind us. Other than MFI, the asset quality of IDFC has always been stable for over a decade through cycles and continues to be so with Gross NPA at 1.86% and Net NPA at 0.52% as of 30th September 2025. On cost of funds, we expect it to drop from here on. The bank is witnessing improving operating leverage. For instance, in FY25, total Business, i.e. loans and customer deposits, grew by 22.7% YoY, against increase in Opex of 16.5% YoY. Following on, in H1 FY26, total Business grew by 21.6% YoY, against Opex increase of 11.8% YoY. We hope to sustain this trend.”

(ADVERTORIAL DISCLAIMER: The above press release has been provided by BusinessWire India. ANI will not be responsible in any way for the content of the same)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages