New Delhi [India], September 4 (ANI): The GST Council on Wednesday recommended rationalisation of the current four-tiered tax rate structure into a citizen-friendly ‘Simple Tax’ – a two-rate structure with a Standard Rate of 18 per cent and a Merit Rate of 5 per cent.

There is a special de-merit rate of 40 per cent for a select few goods and services.

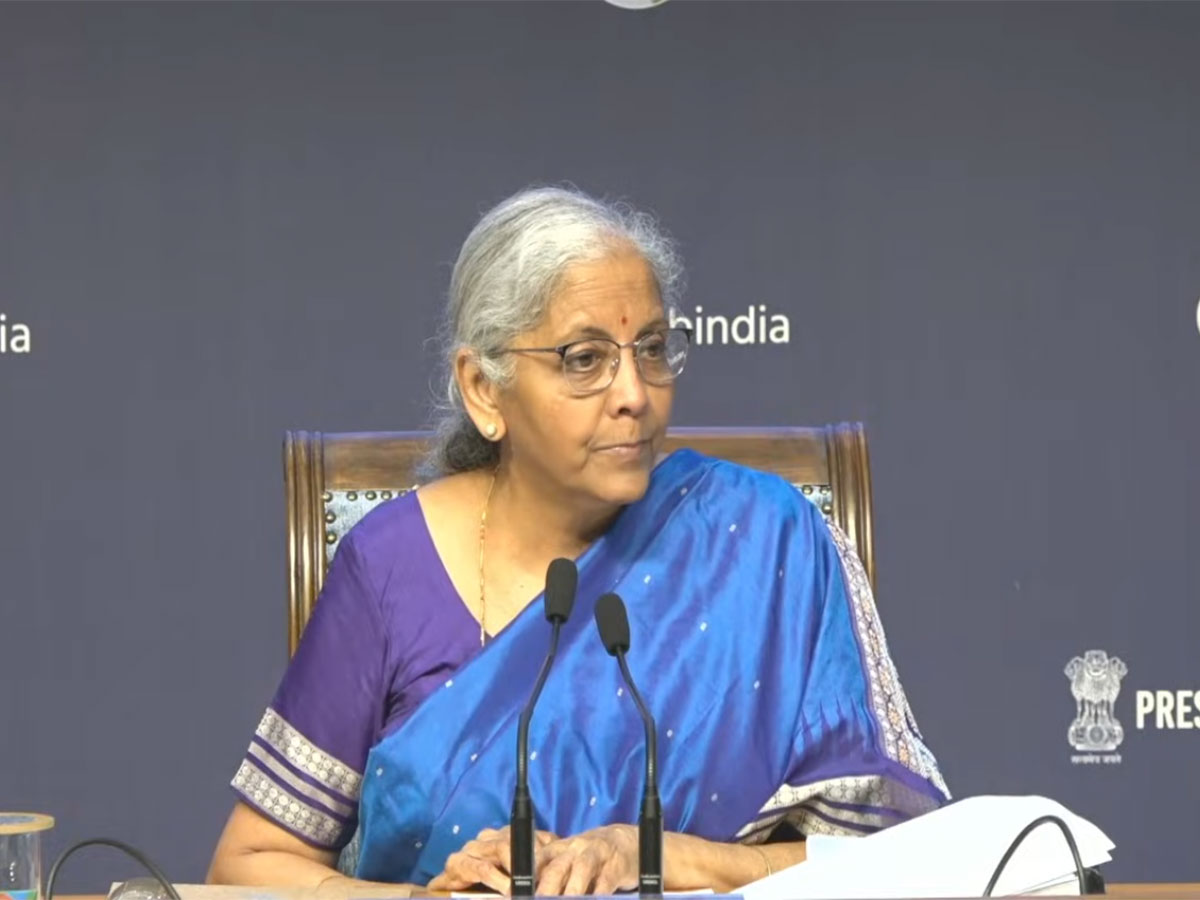

Union Finance Minister Nirmala Sitharaman described the changes, effective September 22, as a “next-generation GST reform” aimed at rationalising rates, correcting inverted duty structures, and making compliance easier.

Addressing the media after the Council meeting at the National Media Centre, Sitharaman said, “Let me first say that the honourable PM actually set the tone for the next generation in reforms on the 15th of August when he spoke from the Red Fort. He desired that we give benefits to the people at the earliest. This reform is not just on rationalizing rates. It’s also on structural reforms. It’s also on ease of living, so that businesses can do their business with GST with great ease,” she said.

She added, “We have corrected inverted duty structure problems. We have resolved classification related issues and ensured stability and predictability. We have reduced the slabs. There shall be only two slabs, and we are addressing issues of compensation, ease of living, simplifying registration, return filing and refunds.”

On relief to households, she said, “Reforms have been carried out with the focus on the common man. Every tax levied on the common man’s daily-use items has gone through rigorous scrutiny, and in most cases, the rates have come down drastically. There is a complete reduction for common man and middle-class items.”

GST on hair oil, toilet soap, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware and other household items has been reduced from 18 per cent or 12 per cent to 5 per cent.

UHT milk, paneer and Indian breads have moved from the 5 per cent slab to nil, exempting them from GST.

Reduction from 28 % to 18%- Air conditioning machines, TVs which are over 32 inches, all TVs now at 18%, Dishwashing machines, small cars, and motorcycles equal to or less than 350 cc are all now coming to 18 %.”

Namkeen, bhujia, pasta, chocolate, coffee, agricultural machines, threshers, composting machines, bio-pesticides, handicrafts, intermediate leather goods, marble, granite blocks and natural menthol will now attract 5 per cent instead of 12 per cent.

The rate on cement has been brought down from 28 per cent to 18 per cent.

Thirty-three life-saving drugs and medicines, including cancer drugs, have been fully exempted from GST, down from 12 per cent to nil.

Spectacles and goggles will now be taxed at 5 per cent, reduced from 18 per cent.

Insurance premiums on individual life policies, health policies, family floater schemes and policies for senior citizens have been brought down to nil from the earlier 18 per cent.

In the auto sector, small cars, motorcycles below 350cc, three-wheelers and all auto parts will now attract 18 per cent GST, compared to the earlier 28 per cent. Motorcycles above 350cc and aircraft for personal use will be taxed at 40 per cent.

GST on man-made textiles — fibres, yarns and fabrics — has been rationalised to 5 per cent under a fibre-neutral policy.

Fertilisers will now attract 5 per cent GST, reduced from 18 per cent.

Renewable energy equipment, including windmills, biogas plants, waste-to-energy devices, solar cookers and solar water heaters, will be taxed at 5 per cent, down from 12 per cent.

Sin goods such as pan masala, cigarettes, gutka, chewing tobacco, aerated sugary drinks and carbonated beverages will attract 40 per cent GST, which will now be levied on retail prices instead of ex-factory prices. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages